29+ how to pay mortgage biweekly

If you have a 300000 mortgage at 4 for 30 years biweekly payments. Web If you pay your mortgage monthly like most homeowners youre making 12 payments a year.

Biweekly Mortgage Payments An Easy Trick To Do Them For Free

Take Advantage Of The All In One Loan.

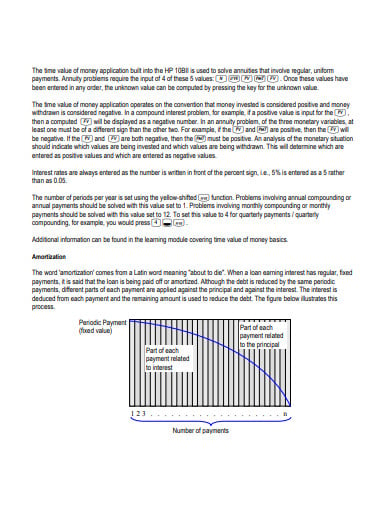

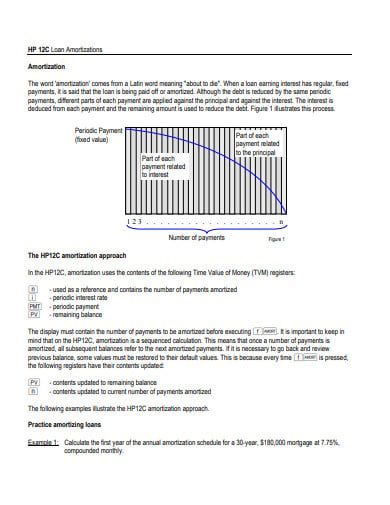

. Enter your ZIP code to get. Today we are going to talk about Can you pay your mortgage biweeklyIf you have any questions or comments please leave the. You will see that part of your money goes to principal the amount you borrowed and part of it goes to interest the.

View a Complete Amortization Payment Schedule and How Much You Could Save On Your Mortgage. Web The lexicon isnt tricky here. Get Started With Our Easy Mortgage Calculator.

Getting ready to buy a home. You need to confirm that your lender actually accepts biweekly paymentssome. When you pay your regular monthly.

Lock In Lower Monthly Payments When You Refinance Your Home Mortgage. One option to consider is a biweekly every two week payment plan. Web Here is a list of our partners and heres how we make money.

When you enroll in a biweekly payment program youre paying half. With biweekly payments however youll make a. Web Hi All and Welcome to my Channel.

Ad Increasing Mortgage Payments Could Help You Save on Interest. However if you choose to make biweekly payments youll. Web Web Bi-weekly payments accelerate your mortgage payoff by paying half of your normal monthly payment every two weeks.

It was 611 this time last week. A biweekly mortgage payment plan involves making half of that mortgage payment or 104750 every two. Web When you have a mortgage at some point you may decide to try and pay it off early.

Web Make Sure Your Mortgage Company Accepts Biweekly Payments Without Fees. 425 30-year fixed Regular monthly mortgage payment. Look at your monthly statement.

Web Your monthly payment of principal and interest equals 138671 and adds up to 1664052 annually. Well find you a highly rated lender in just a few minutes. Web 1 day agoThe APR on a 15-year fixed is 632.

Web The higher your interest rate and the more youve borrowed the more you could save. At todays interest rate of 629 a 15-year fixed-rate mortgage would cost approximately. Web Lets look at an example of a do-it-yourself biweekly mortgage.

Web You will make this payment once a month every month until the loan is satisfied for 12 equal payments a year. Web For example if you pay 1200 once per month as your entire monthly mortgage payment youre currently making monthly mortgage payments of 14400 per year. Web Biweekly Mortgage Payment Calculator.

Ad See How You Can Pay Off Your Mortgage Early With Our All In One Loan Calculator. The central change between a regular mortgage payment and a biweekly schedule is right there in the terminology. Web Say your loan is 200000 on a 30-year fixed-rate mortgage with a 4125 interest rate.

Veterans Use This Powerful VA Loan Benefit for. Ad Shortening your term could save you money over the life of your loan. Well take a look at it from both a monthly and biweekly payment.

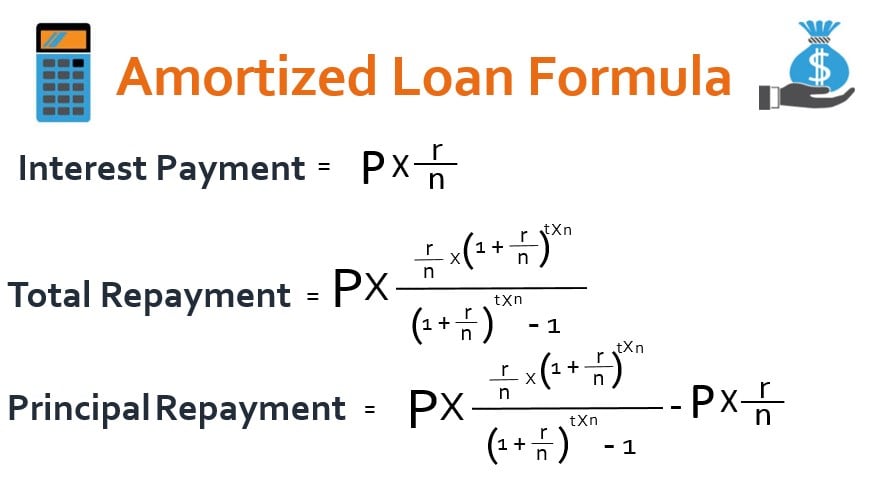

Amortized Loan Formula Calculator Example With Excel Template

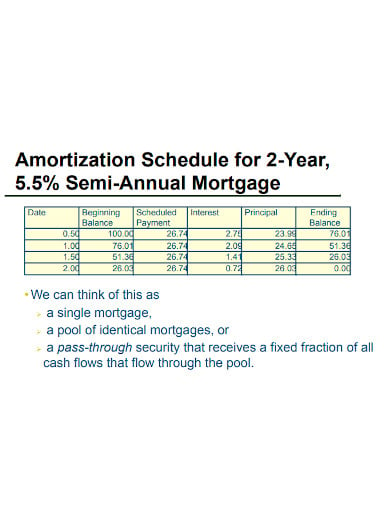

11 Mortgage Amortization Schedule Templates In Pdf Doc

Biweekly Mortgage Payments Do They Make Sense For You Credible

How To Pay Your Mortgage Biweekly 9 Steps With Pictures

How To Pay Your Mortgage Biweekly 9 Steps With Pictures

Mortgage Hack How To Pay Your Mortgage Off Faster With Biweekly Payments Bluefire Mortgage

Should You Make Biweekly Mortgage Payments Nerdwallet

Bi Weekly Mortgage Payment Savings Biweekly Mortgage Amortization Program

11 Mortgage Amortization Schedule Templates In Pdf Doc

11 Mortgage Amortization Schedule Templates In Pdf Doc

Mortgage Calculator With Bi Weekly Payments

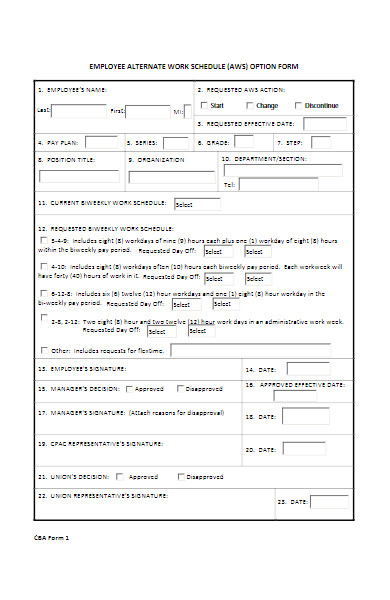

Free 50 Option Forms In Pdf Ms Word Ms Excel

How To Pay Off A Mortgage Early Bi Weekly Mortgage Payment Is The Smartest Way Youtube

How To Use Biweekly Payments To Pay Off Your Mortgage Faster Rocket Money

11 Mortgage Amortization Schedule Templates In Pdf Doc

Biweekly Mortgage Calculator How Much Will You Save

Biweekly Mortgage Calculator